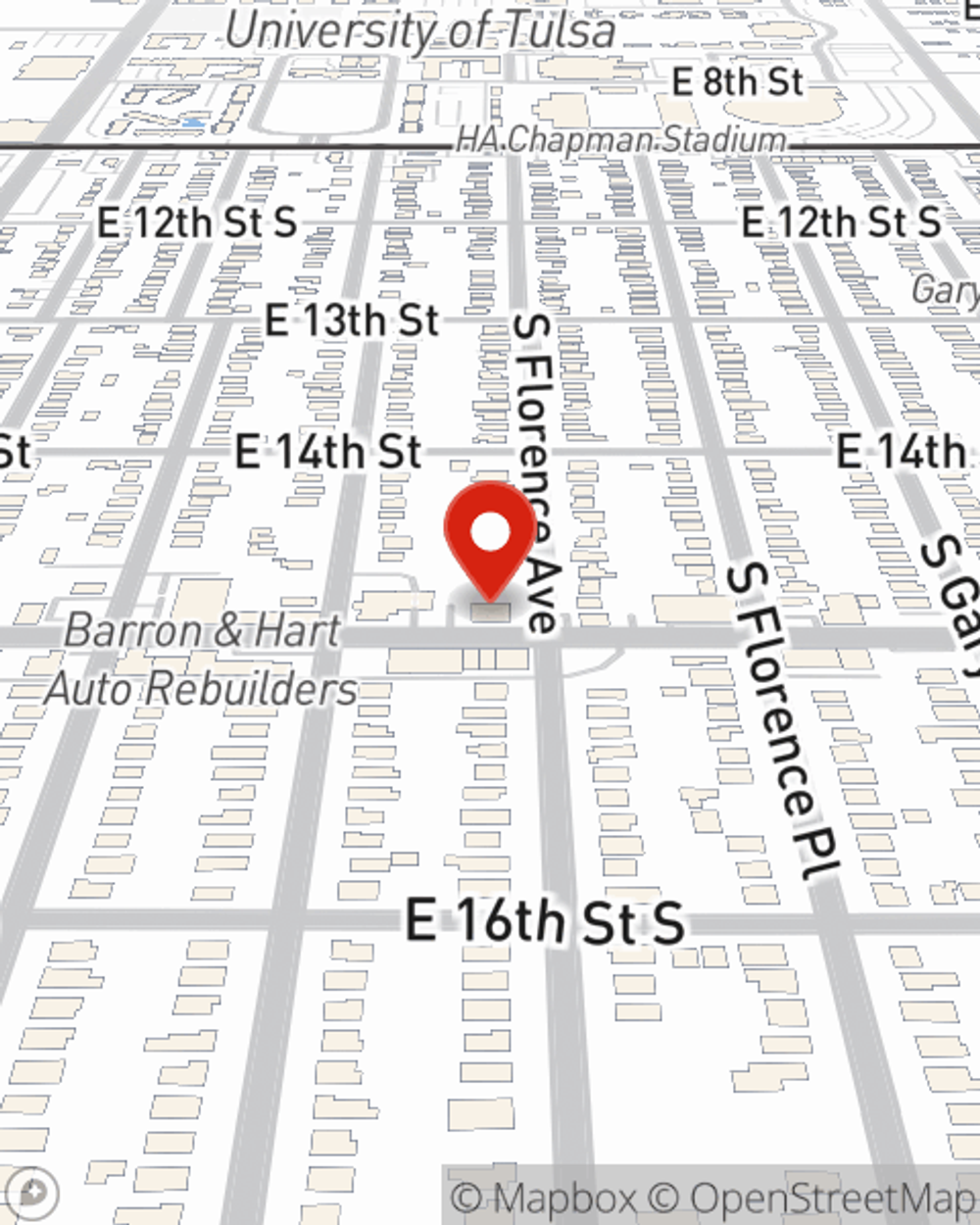

Business Insurance in and around Tulsa

Looking for small business insurance coverage?

Cover all the bases for your small business

- Tulsa, OK

- Hot Springs, AR

- Fayetteville, AR

- Little Rock, AR

Cost Effective Insurance For Your Business.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like worker's compensation for your employees, business continuity plans and a surety or fidelity bond, you can feel comfortable that your small business is properly protected.

Looking for small business insurance coverage?

Cover all the bases for your small business

Strictly Business With State Farm

At State Farm, apply for the excellent coverage you may need for your business, whether it's an ice cream shop, a bakery or a clock shop. Agent Shannon Grisham is also a business owner and understands what you need. Not only that, but personalized insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Call or email agent Shannon Grisham to learn more about your small business coverage options today.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Shannon Grisham

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.